Let's veer into the political economy today, a sort of third rail of market and economic commentary. The reason I want to discuss it is the tax grab contemplated by the Biden Administration in the US.

Yesterday, news came out that Biden is to make good on his promises to raise taxes on the rich and corporations. In this case, it is via a capital gains tax increase to go along with his mooted corporate income tax increase. The combination is toxic for equities. And it has a lot of people up in arms.

So let's talk about this from a political perspective, because, in my view, taxes are mostly a political issue and less a revenue-generating issue.

As I write this post, be aware that I intend to use some emotionally-charged language like 'tax grab', 'tax and spend', 'crony capitalism', 'coercion' and 'peasant revolt'. Usually I avoid emotionally-laden language but I think it's appropriate here because, when you veer into tax policy, you're necessarily going into an emotionally-charged subject. And so the emotions conjured up should be explicit in the language you use to make everyone consciously aware of those emotions.

Tax and Spend

Back in the 1970s and 1980s when I was growing up, the Democratic Party was considered the party of high taxes and big government programs. This was a changing landscape because, in the wake of the Great Depression, the New Deal, and World War 2, Keynesian economics was ascendant. And the power of government to do good was a part of the prevailing ethos after World War 2.

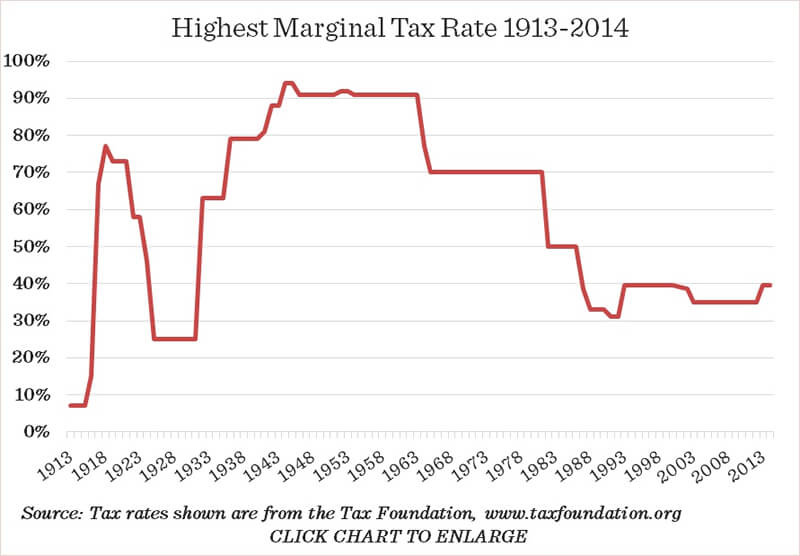

The thinking at that time was that government's role was to be expanded to provide a less porous social safety net while taxes would be highly progressive in order to pay for programs and create a sense of fairness. For example, even under Eisenhower, the highest marginal personal income tax rate was 90%.

I wrote about why this was so, a decade ago, back in 2011:

A few months ago, Michael Hudson answered the question, "Why Did America Have A 90% Income Tax Under Eisenhower? ". He says the original premise of the income tax law was based on 18th and 19th century classical economics and the price theory of economic rent. First and foremost, Hudson says that meant to the economists of the late 19th century and early 20th century that America would get rich through productivity gains that came from the work of highly paid labour. Hudson argues that is why Asia is more productive today: because living standards are increasing. However, to the degree one made considerably more than the average income, Hudson argues it was assumed in the early 20th century that this was the result of rent-seeking or monopoly privilege of the sort we saw during feudalism. Therefore this income was largely taxed away.

Rent-seeking: this is exactly why 19th century author Henry George talked about a land value tax.

But this whole idea of high marginal rates to deter presumed rent-seeking faded after the Great Society programs of the 1960s and the inflation of the 1970s. The thinking increasingly became the opposite of the era that preceded the 1970s. Allegedly, excessive and wasteful government spending was pushing up demand and overheating the economy, causing inflation. And because the private sector was seen as more efficient, the right thing to do was reduce government spending and taxes right along with it so that people could keep and allocate their capital as they see best.

So, what used to be seen as government doing good things became government doing bad things. And the Democrats, who were most wedded to the benevolent government ideology, were pilloried as wanting to 'tax and spend'.

Give Me My Money

So, by the time Bill Clinton came along, Democrats had a chip on their shoulder about fiscal rectitude. And Clinton sought to remake the party's image by keeping government spending in check and even running government surpluses.

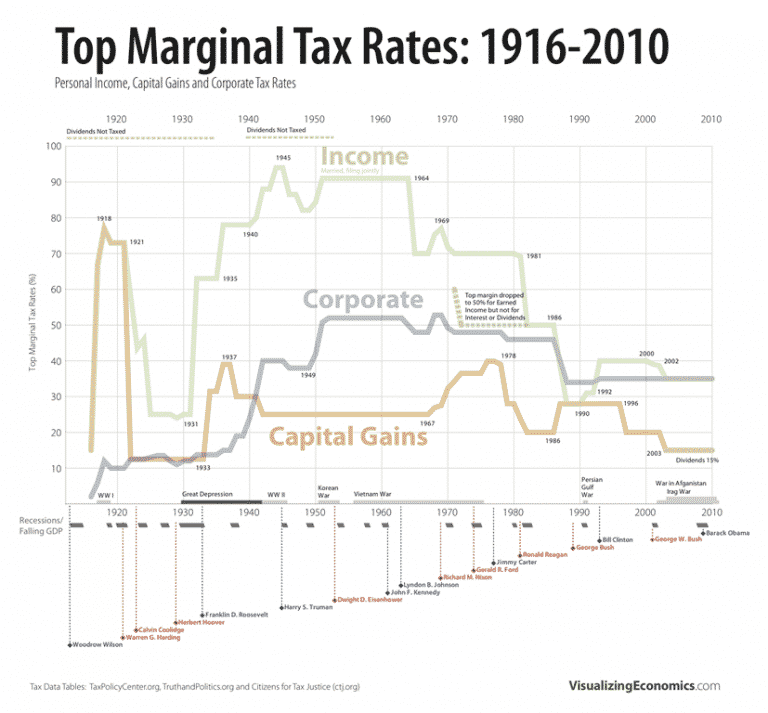

The Zeitgeist was that the private sector was efficient. "Give me my money" is the right slogan for that age. Individuals and businesses collectively were seen as much better at deciding how to allocate capital than government. And so taxes came down across the board, not just for personal income, but also for corporations and capital gains.

Here's an image I used in the 2011 post I quoted above.

And note, this trend toward less government and lower taxes was global. Even countries like Sweden, known for having high taxes, moved to reduce the role of government in order to boost growth.

Income and Wealth Inequality

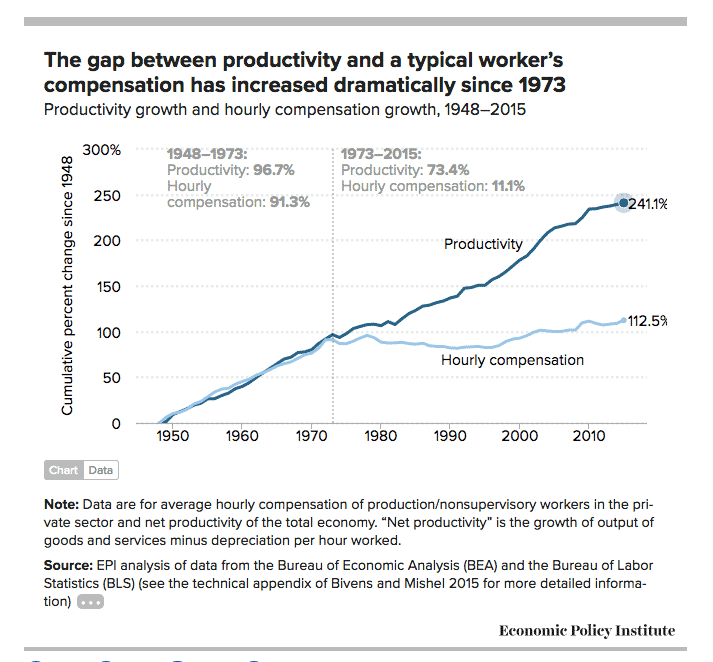

Have you seen this chart below?

I first posted in 2017, when writing about rising healthcare costs and Baumol's disease. Here's how I described what it's telling you:

rising wages across the economy put huge pressure on labor intensive economic sectors because they cannot use productivity gains to reduce the impact of labour costs on their income statement. The result is a cost pass-through to consumers in those sectors of the economy. We’re talking about essential economic sectors like healthcare and education. This is something Baumol sketched out back in the 1960s.

[...]

[The chart above] basically shows the gains of productivity growth going to the captains of industry rather than wage earners. Basically, it’s rising inequality boiled down into one chart. And this is a big problem if the picture Wil Baumol painted about industries like healthcare is true... it means that average wage earners will be under severe economic pressure.

Translation: Despite massive productivity gains in the economy, wages are barely keeping up with inflation. Why? Most of the gains are going to the wealthy. Meanwhile, many costs for middle class folks are rising faster than wages.

That's what income and wealth inequality is all about. It's about a world in which a rising tide was supposed to lift all boats, but it ended up lifting the bigger boats a lot more than the others. And the smaller boats took on water and are busy bailing that water out lest their boat sinks.

After the Great Financial Crisis, when many working people lost their jobs and their homes, and the Global Pandemic, when many people were forced into unemployment through no fault of their own, this divide in the spoils isn't politically sustainable. You've got people like me working from the comfort of our homes, fully protected from the pandemic, doing just as well as before this crisis. And then you've got a host of other people who have been made jobless or have been forced to work the front lines to make ends scrambling for childcare options in the process.

That outcome has the makings of a 'peasant revolt' if we don't see something change soon.

The Tax Grab

That's the background to the Great Biden Tax Grab. Now, you might find that moniker offensive. But it's still what you're likely to hear in opposition to it because it puts the Democratic Party back into the mode of the 1960s and 1970s, where they were seen as the party of higher spending and higher taxes.

But what choice does Biden have? If he believes the US has a crumbling human capital and physical infrastructure as it prepares to ward off climate change, doesn't that necessarily mean more government spending? Doesn't that spending have to be 'funded' by higher taxes? My answer is no to both questions. But I think this is a complicated topic that I can't adequately cover in the space I have remaining today. I'll try anyway though.

First, taxes don't 'fund' federal spending. The US government funds itself by creating fiat money IOUs that it can create in infinite quantities. We understand this now because during the pandemic we have seen a massive increase in spending without taxes going up. And it's meant no penalty on interest rates or on currencies (though some say it is why cryptocurrencies are doing well instead of their benefitting from a mania) .

The conventional argument is that this is simply an intertemporal advantage that government has relative to individuals. The conventional thinking is that eventually the government surely must raise taxes to fund itself. But this is incorrect. The norm for the US government is deficits. Look at the numbers.

The right way to think of federal deficits is as net asset transfers to the private sector. The government is making the transfer and then taxing back some of that transfer and issuing IOUs in the form of bonds for the rest. The question is what the right mix of taxes and IOUs is, what level of deficit spending the government can get away with before inflation or loss of faith in the currency (IOU) takes place.

Clearly you have to collect some taxes to give the IOUs value as money. After all, if I have to pay you a tax tribute in your IOU, as does everyone else, under penalty of prison, that's a pretty strong coercive power in giving your IOUs value.

But the question is how much I should collect and from whom. I think that's a debate whose answer is unknown and largely unknowable. And so, this is where the politics come into play. This is exactly where the Biden Tax Grab creates problems, because as soon as you start raising taxes you have to justify why you're doing it. And that's an entirely political argument since taxes don't actually fund spending.

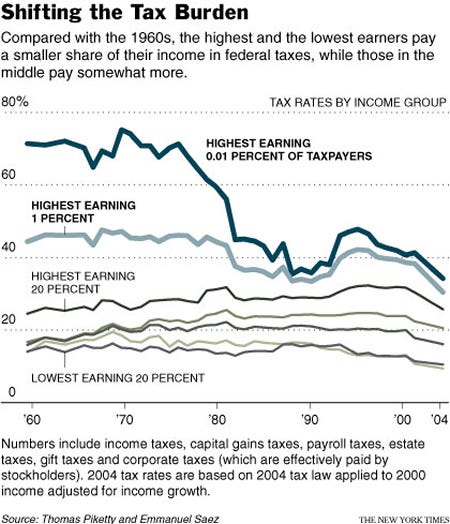

One could argue that Biden could simply do nothing and watch the economy return to full employment. But, if you're a Democrat, your knee-jerk is to be 'fiscally responsible'. And so, as convention would dictate, any increase in spending has to be funded by an increase in taxes. And in a world where median wages are barely keeping up, it's a lot easier to hit corporations and the rich who have made out well over the last several decades. That's the politics.

My View

I am a low tax, limited government guy by default. Part of that is an outgrowth of having grown up in the 1970s and 1980s when this was the mantra. But a lot of it stems from my libertarian sensibilities and distrust of the coercive power of government.

At the same time, I would argue that the form of capitalism practiced in the US right now is more crony capitalism than actual capitalism. It's a world of special interests and incumbent large corporations currying favor with government and getting special dispensation to the detriment of small businesses and wage-earning individuals. It's a world where the pendulum has swung too far.

How do you fix that? Do you raise taxes on the rich? My knee jerk there is to say no but I am open to understanding the specifics.

If I were designing the system from scratch, I would have:

low tax rates, overall (ideological)

a flat structure with less progressivity than we have now (fairness to high earners)

a high personal exemption (fairness to low earners)

an equivalence on tax rate structures across business, capital gains, carried interest rates and personal income (fairness overall)

an elimination of loopholes including mortgage interest deduction (simplicity)

The overall goal would be to make people indifferent to how and where they earn their money. You want to minimize tax status arbitrage even if it means some loss of capital formation. And that's simply because the people most able to switch tax status are the rich, which, in our system now, means that marginal rates for the wealthy are sometimes lower than they are for wage earners (see here about Warren Buffett).

You can do that by harmonizing rates, simplifying tax structures and eliminating loopholes. Set the rates in this simplified structure such that the working and middle class pay largely the same amount as before but where the overall tax structure is simplified and easier to understand.

In the end, special interests stop that from happening because they (often successfully) argue that their form of enterprise should be favored in some way for the greater good. And once you go down the corporatist slippery slope, every interest group is looking for a special lower tax status.

The overarching premise is to have the system appear fair and for it to be simple because that promotes a sense of community and inclusion. The United States is becoming a fractured nation where it is more us versus them and less about shared and collective binds.

Of course, this is never going to happen. But I can hope. Have a good weekend.

Overall, I like your proposal and would love to see it happen, but I agree it never will. I think you're correct about treating income from all sources the same if only to give the tax system a sense of fairness. In this regard, I loathe the carried interest rule, but it survives both Democrat and Republican administrations due to the political influence of the finance industry. Maybe Biden will finally change it.

Two of your points I might quibble with, but perhaps only because you couldn't address all of the details in this post. First, I think the current income tax rates are already very flat, with the top bracket of 37% applying to married couples earning over $622,000. That's probably the top end of the upper middle class in some high income coastal areas. I think brackets at say a million and ten million dollars (say 40% and 43% respectively) would add to a sense of fairness that the very wealthy are paying more. Second, I don't really think of the mortgage interest deduction as a loophole since originally all interest was deductible and correspondingly treated as income to the recipient of the interest. This makes logical sense in that the idea was to tax income only once and through the payment of interest a taxpayer was merely transferring some income to another taxpayer who would then be taxed on it. Over time the interest deduction was whittled away until mortgage interest was all that's left. That said, I'd support eliminating the deduction as part of an overall simplification of the tax code. Thanks for sharing your thoughts on this topic.

I think this is my favorite article of yours. Thank you, Ed. Baumol's disease is such an important insight. I remember reading Paul Craig Roberts complain that his idea for the Reagan tax cuts was to raise productivity in scalable jobs, such as manufacturing. The secondary effect would have been as Baumol claims. Instead, those jobs were off-shored, and we were left with the America we have today. Roberts made it clear that the blame for abusing his tax cuts was on both the Dems and the GOP.